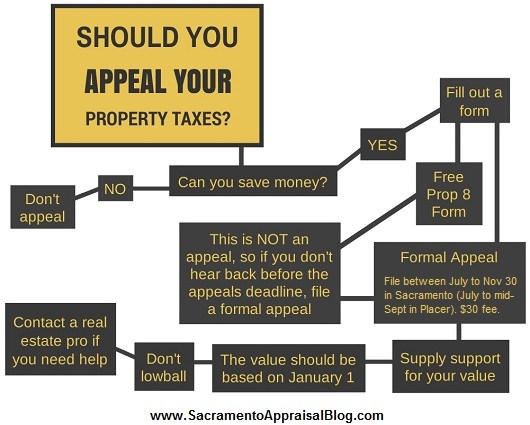

This is how the property tax appeals process typically works. Though there are situations where owners have back-taxes for many years (escape assessments), and there is a different process for that.

Think about your property tax assessment this way:

- Assessed Value $25K high = you overpay by $250 per year

- Assessed Value $50K high = you overpay by $500 per year

- Assessed Value $100K high = you overpay by $1,000 per year

- Assessed Value $150K high = you overpay by $1,500 per year

- Assessed Value $200K high = you overpay by $2,000 per year

Sometimes property owners choose to opt out of appealing property taxes because of the expected hassle of it all or a lack of knowledge for what to do. At times too it can feel daunting to delve into the unfamiliar turf of reducing property taxes. But don’t worry, that’s where we come in.

If you wonder if your property is assessed too high, let’s talk. One phone call or email could dramatically help your situation. We are able to assist you by providing a reliable and thorough analysis of real estate market trends in your neighborhood as it relates to your particular property. As a consultant for you, we will file the appeal, do the research, produce a credible and convincing value opinion, and stand before your appeals board to argue in your place.

You do not need a full appraisal to appeal your property taxes in many cases.

Taxes are a part of life and there is no escaping them, but we don’t want to pay a penny more than we have to. Make sure that you are keeping your hard-earned money in your pockets by paying your fair share of property tax and no more.

Our company is based in Sacramento and we are proud to do business locally and serve our community.

Lundquist Appraisal Company

TEL: 916-595-3735

www.LundquistCompany.com

lundquistcompany@gmail.com